In 2008 the neo-liberal international financial sector collapsed. And was saved with public money [citizens´, taxpayers´ money]. The highly interconnected system appeared to be dangerously fragile. Today, the vulnerability of the industry is at the center of worldwide attention especially among investors and governments because of the consequences of climate change [leading to stranded or damaged assets] and even biodiversity loss. But the focus is not on the instability of the system itself, which has been modified only marginally, not fundamentally, since 2008. That’s dangerous myopia.

I think that the systemic risks in the financial sector, as they still exist today, are more dangerous in the short and midterm [<10 years] than climate change.

Indeed, there is more capital in the system, more common supervision in Europe, more transparency in derivatives, but it is all far too insufficient. ‘Systemically important‘ financial institutions have not changed in size and complexity and still pose a major risk to financial stability. And the ´moral sentiments` in the higher echelons of management and trading haven´t changed enough either. None of the structural vulnerabilities of the sector have been tackled conclusively. The supervisory authorities and the ´big 4` accounting firms are still not up the task, and we depend on whistle-blowers: see the recent CumEx and Wirecard scandals in Europe.

My opinion, though I´m not a financial expert, based on following major developments on Wall Street for more than 20 years, is quite outspoken.

The book “Systemic Risk in the Financial Sector” provides a collection of essays by experts, by all means, a more balanced view:

“This publication draws on some of the world’s leading experts on financial stability and regulation to examine and critique the progress made since 2008 in addressing systemic risk. Systemic Risk in the Financial Sector is the definitive guide to understanding the global financial crisis, the safeguards being put into place to try to avoid similar crises in the future and the limitations of those safeguards”.

Finance Watch is an independent, non-profit, public interest association dedicated to making finance work for the good of society. It started in 2011 and is based in Brussels and its 15-person staff includes former bankers, derivatives traders, and lobbyists. People with deep academic and practical knowledge of the sector. It focuses on improving European financial regulation. The world of finance cannot control itself, while politicians very often lack the necessary knowledge and experience to counter strong financial lobbies. In 2018 they published a very informative [and sobering] review of the state of the art, 10 years after the crises.

If you are not yet aware of this organization, I heartily recommend a visit to their website.

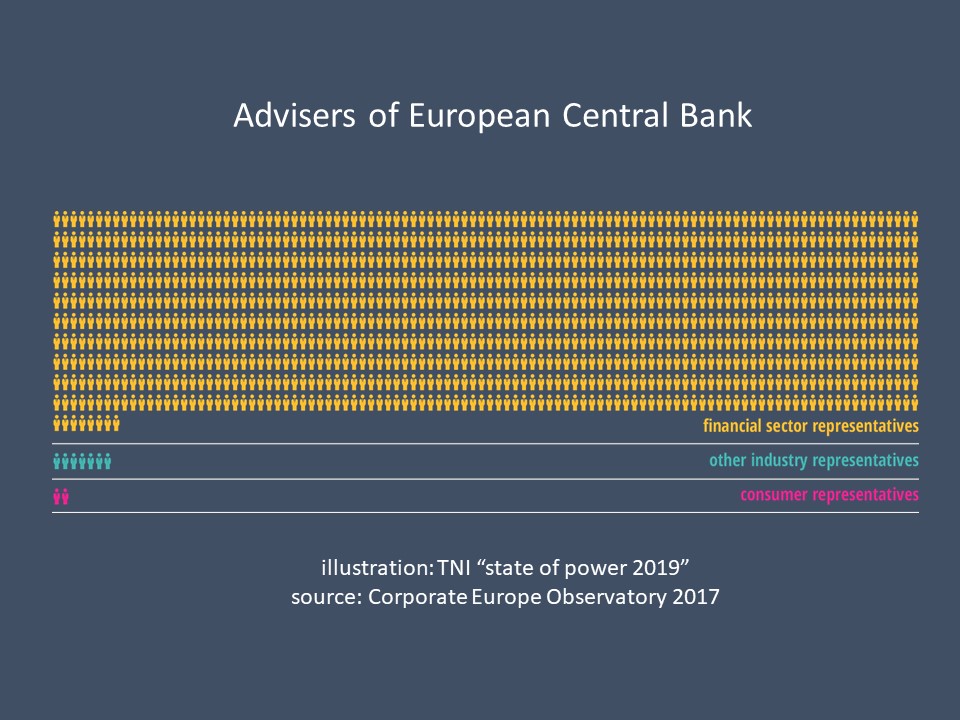

This illustrative information, based on research by the civil society organization Corporate Europe Observatory, dates from 2017.

Christine Lagarde became the new ECB president in November 2019. Hopefully, she has already somewhat restored the balance of influence and will continue to do so energetically …

Another illustration of the power that the financial sector can mobilize in Brussels…. [illustration: CEO].

In February 2020 Executive Director Adam Farkas of the European Banking Authority [which supervises the banking sector], became Chief Executive of the Association for Financial Markets in Europe [AFME], a coalition of megabanks set up to lobby the EU institutions. AFME is an alliance between the biggest US banks and their European counterparts. Mr. Farkas´ salary at AFME approximately equals Finance Watch’s yearly available total budget.

Few of the general public know that 10 years before the financial crisis in 2008, there already was a major event that potentially could have led to a collapse of Wall Street….

Long-Term Capital Management L.P. was a hedge fund founded in 1994 by John Meriwether, Myron S. Scholes, and Robert C. Merton, who shared the 1997 Nobel Memorial Prize in Economic Sciences for a “new method to determine the value of derivatives”.

It had off-balance sheet derivative positions with a notional value of approximately $1.25 trillion. Initially successful in 1998, it lost $4.6 billion in less than four months. It collapsed, and agreed on September 23, 1998, with 14 heavily involved US and European megabanks for a $3.6 billion recapitalization under the supervision of the Federal Reserve, to avoid a wider collapse in the financial markets.

It would have triggered a global financial crisis due to the massive write-offs its creditors would have had to make. The fund was liquidated and dissolved in early 2000.

It was a revelation, a shock to me, that a very small group of [admittedly] brilliant and “seasoned” individuals were potentially able to implode the global financial system. For the first time, I realized how fragile – and dangerous – this financial system had become.

John Meriwether

Myron Scholes

Robert Merton

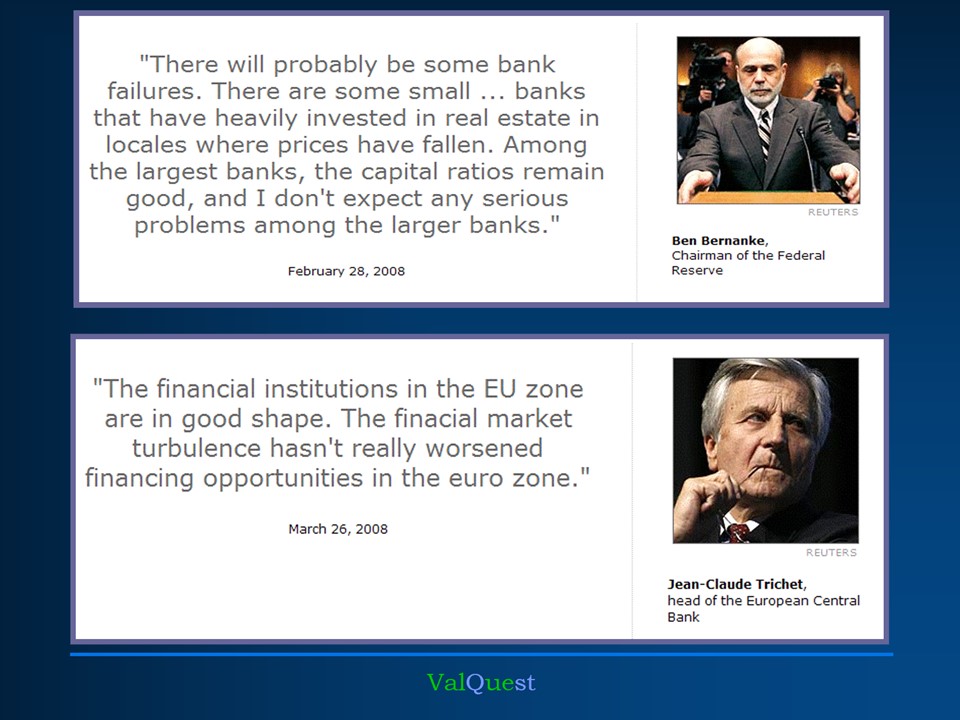

Shortly before the system collapsed on September 18, 2008, the two top executives from central banks in the USA and Europe allayed concerns about fundamental problems within the financial sector.

Martin Wolf is the associate editor and chief economics commentator at the Financial Times. He is regarded as “staggeringly well connected” within financial circles. He is trusted for his independence and is widely respected as one of the most influential economics journalists in the world.

Financial Times, 19 March 2019

In this article, Martin Wolf argues that regulation has tightened since 2008. But then states that these regulations will be loosened, and provides 4 reasons why this tends to happen [“we learn from history – and then we forget”]: economic, ideological, political, and human. Very worth reading…

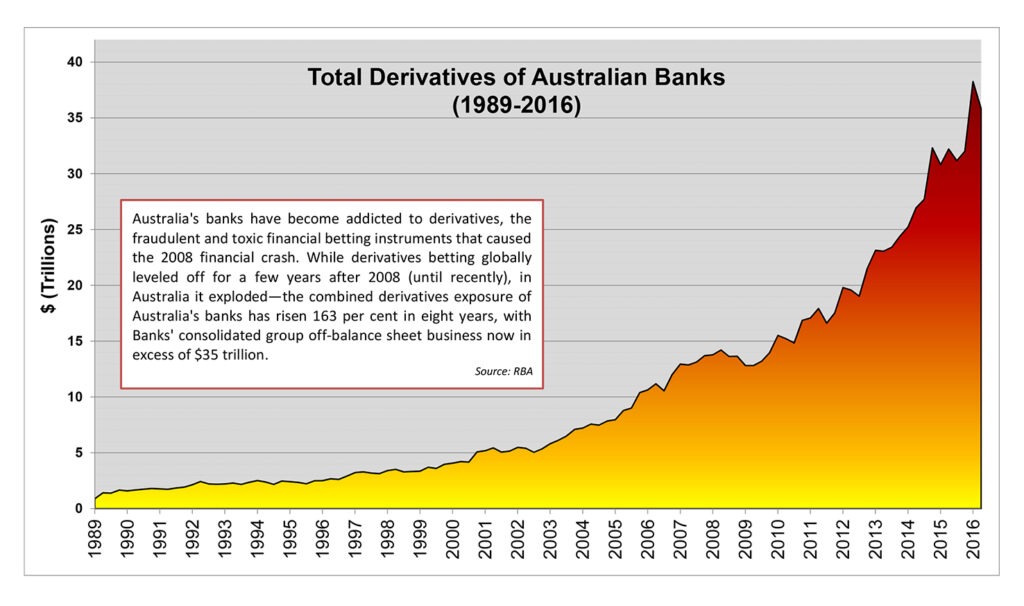

An example of the exponential growth of derivatives, in Australia. Not the most recent data, unfortunately. But it clearly shows the temporarily leveling off after the 2008 crisis, and strong uptake again since 2011.

Source: Reserve Bank of Australia [illustration Citizens Electoral Council of Australia]

The real size of the derivatives market is unknown, but experts estimate it to be more than 10 times that of the total world economy. It totally baffles me how this is possible.

The happy assurance of financial experts that this is “just the nominal value” does not reassure me at all. On the contrary. Derivatives are very complex financial instruments. How dangerous is this practically unregulated monster?

They are still too dangerous in my personal view. Financial regulators have done some work to reform the derivatives markets, which nearly pushed the financial crisis of 2008 into a global disaster. But their work is unfinished.

Derivatives can be useful in mitigating risks, if they are kept straightforward – simple. But in highly complex constructions they can also quickly generate losses large enough to destabilize the entire financial system.

Financial experts tell me that the “notional value” of the derivatives market is a “misleading large figure” – one should look at the gross market value, which seems to be 3 – 4% of notional outstanding. And after further risk reduction by so-called “netting”, the exposure could be less than 1% of notional outstanding.

Simple arithmetic learns me that 1% of 10x the world economy in 2019 is still an impressive $9 trillion. Which is almost equal to the size of the economies [2019] of Germany, France, Italy, and Spain put together …..

photo: Audacity Capital

illustration: Hackaday

High-frequency trading [HFT] refers to trading in financial instruments, such as securities and derivatives, transacted through powerful supercomputers executing trades within microseconds, using algorithms and artificial intelligence.

High-frequency trading has grown considerably over the past 15 years: estimates are that it accounts for roughly 55% of trading volume in U.S. equity markets and about 40% in European equity markets. Likewise, HFT has grown in futures markets—to roughly 80% of foreign exchange futures volume and about 2/3 of both interest rate futures and Treasury 10-year futures volumes.

[USA Congressional Research Service, “High-Frequency Trading: an overview of recent developments” – April 4, 2016].

“Various observers, including SEC staff, have said that the aggressive strategies of HFT should be a central focus of public policy concerns. This may be because such strategies can share some similarities to practices such as front-running and spoofing, which are generally illegal. In addition, regulators have expressed concern over whether certain aggressive HFT strategies may be associated with increased market fragility and volatility, such as that demonstrated in the “Flash Crash” of May 6, 2010; the October 15, 2014, extreme volatility in Treasury markets; and the August 24, 2015, market crash in which the Dow Jones Industrial Average fell by more than 1,000 points in early trading”.

Regardless of the dangers that HFT entails, one thing is at least once more completely clear to me, now that it appears that at least 40% [Europe] to more than 55% [USA] of the shares change ownership fully automatically in microseconds: the claim that the shareholder “owns the company” & is the one who takes the highest risks, is an absurd position.

photo: Leap Rate

It lasts 1 hour and 50 minutes, but I can wholeheartedly recommend this documentary if you are interested in the main causes of the financial crisis in 2008.

Financially technical causes; but especially also the business sector cultural elements, degenerated values awareness, fueled by ruthless greed.

This website is a personal narrative, based on 50 years experience in international business, non governmental organisations and consulting practise. My guest lectures at the Institute of Environmental Sciences [Leiden University, The Netherlands] are derived from it.

Ludo van Oyen – Brussels, 2021

Some photos are taken from the web. If you think your photo is used and you disagree, please send me an e-mail and I will remove it from this site.