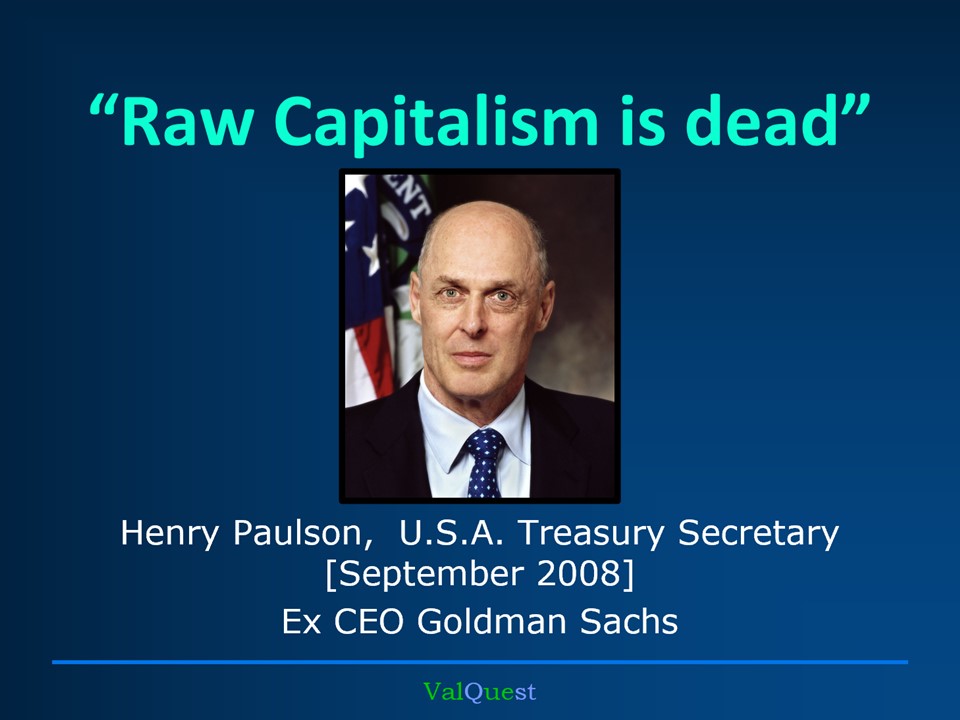

This was certainly an honest, startling statement from the Treasury Secretary at the height of the financial crisis. Moreover, a statement from a former Chief Executive Officer of the possibly most capitalist and – at the time – most successful investment bank in the world: Goldman Sachs.

The elections of Margaret Thatcher [UK – 1979] and Ronald Reagan [USA – 1981] marked the emergence of a new paradigm: Neo-Liberal Economics. The role of the state in facilitating the economy was drastically diminished. Important public organizations [rail transport, water supply, postal and telecom services, i.a.] were privatized. Significant reductions in taxes [especially for the already rich] and public spending were implemented. Markets were deregulated, especially the global financial markets.

Trade unions were curtailed, collective bargaining was characterized as a distortion of markets, and therefore of inefficiency. Policies that aim to create a more equal society were judged to be counterproductive. Neoliberal policies were imposed internationally, through the IMF, Maastricht Treaty, and the WTO. Trade treaties included “investor-state dispute settlement”: offshore tribunals in which corporations can press for the removal of social and environmental protections. Which they have done, successfully. “The market” had become the “Supreme Organiser” of society.

Alan Greenspan – photo: Javier creative commons Flickr

There are two high priests of raw capitalism: Milton Friedman and Alan Greenspan. The latter served for more than 18 [!] years as Federal Reserve chairman.

As a great admirer of Ayn Rand [author of “Atlas Shrugged” – after the bible, the most read book in the USA], he fully believed in the healing, self-correcting effect of free markets.

He strongly opposed regulation, including that of the very rapidly expanding derivatives markets, which turned out to be the highly effective detonators for the explosion of the international financial system in September 2008..

On 23 October 2008, in his now-famous [or infamous] Congressional testimony, he offered a mea culpa:

“Those of us who have looked in the self-interest of lending institutions to protect shareholders´ equity – myself especially – are in a state of shocked disbelief”.

The committee chair then asked him: “You found your view of the world, your ideology, was not right, it was not working?”, Greenspan replied: “Absolutely, precisely”.

For the record, just to be clear: I am a proponent of capitalism. I think it has brought us great progress in terms of health, education, communication, transportation, infrastructure, living conditions, comfort, and wealth in the past 200+ years.

And it has brought us great misery, inequality, and environmental destruction.

It all depends on what kind of capitalism we are talking about. On what economic paradigm it is based. How it is regulated.

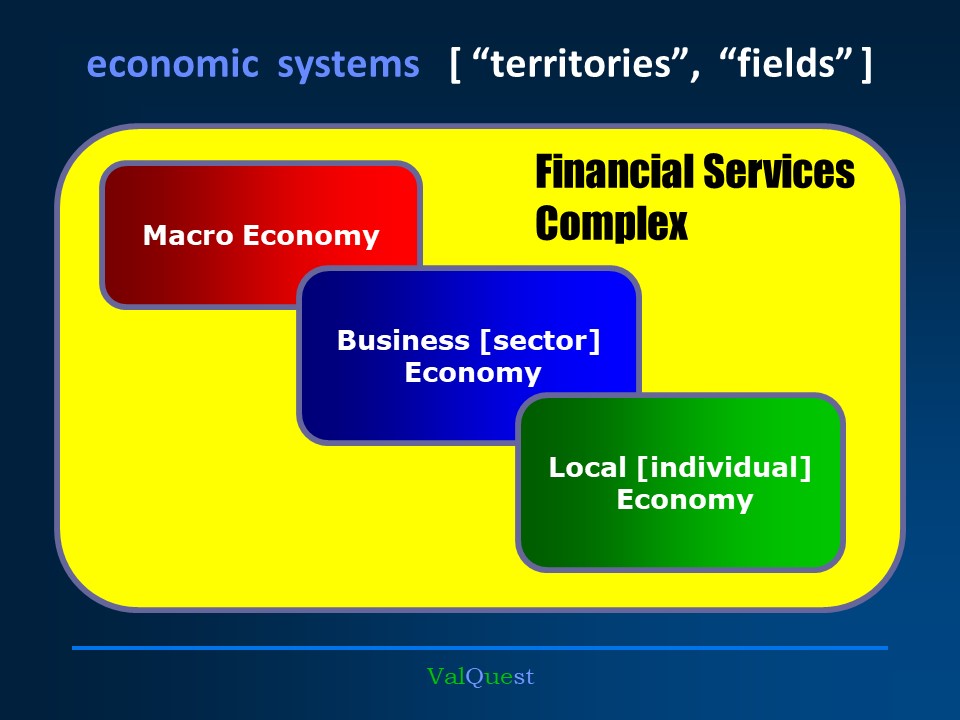

At the heart of the economy functions the business organization – varying from the [very] small to the gigantic transnational corporation with hundreds of thousands of employees, who produce and trade physical products and services and are present in many countries.

Besides products and services, these business companies [amongst others] create jobs and tax income for governments who then can spend it on social security, healthcare, education, infrastructure, the legal system supporting the rule of law, etc., etc.

Capitalism provides the businesses/entrepreneurs the freedom to use all their creativity, inventiveness, knowledge, intellect, experience, their ability to solve problems in teams and international networks, to be flexible and resilient in a dynamic context, to advance technology, and many more competencies. And do so as fast as possible.

The free market system thus brings out the best in people. But unfortunately, it can also bring out the worst, like unbridled greed, lust for ever more power….

The crucial thing is, that an economic system is to a very important extent designed by ourselves: we set the frameworks, based on our conceptual thinking, our vision of what the role of governments must be concerning for instance the provision of social security, healthcare, education, infrastructure, etc. Or that this must/can be delegated to “the market”, to the private sector.

The prevailing paradigm, the dominant framework for the past 35+ years has been neo-liberalism, raw capitalism. That ideology has not worked – to put it mildly.

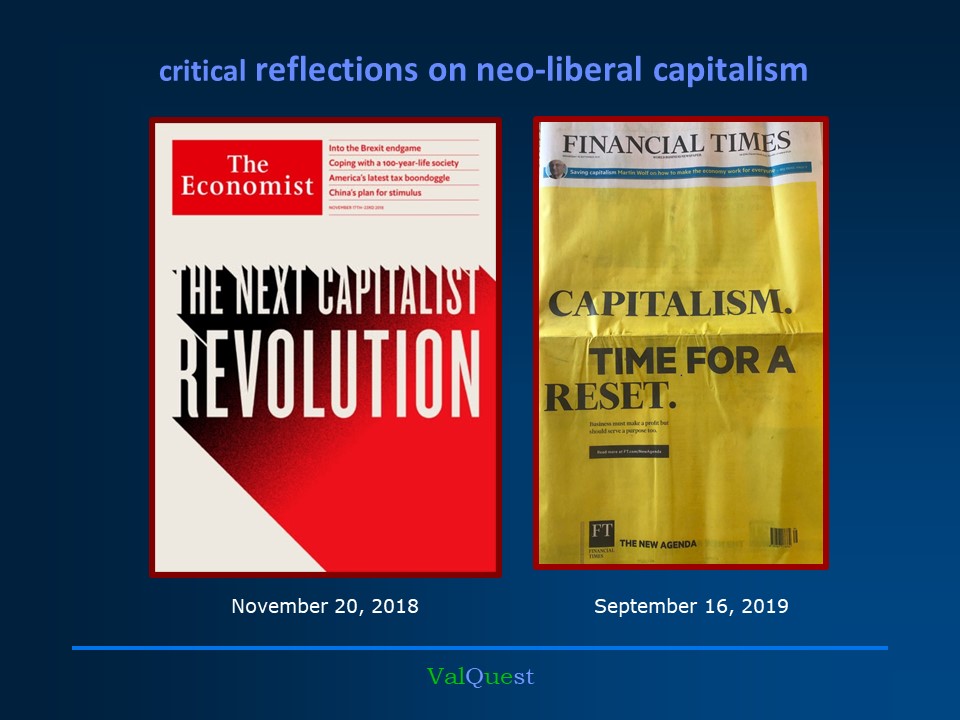

Strong criticism of neo-liberal capitalism has grown ever louder in the past decennium and comes from many directions. There is a growing realization, even in the USA, that capitalism “is killing itself”, and that something has gone terribly wrong. The criticism concerns the USA style “raw capitalism”, but also some European variants.

On September 16, 2019, The Financial Times yellow [!] cover just read “Capitalism. Time for a reset”. In it, Martin Wolf published a landmark article: “Why rigged capitalism is damaging liberal democracy”. His concluding sentence:

“We need a dynamic capitalist economy that gives everybody a justified belief that they can share in the benefits. What we increasingly seem to have instead is unstable rentier capitalism, weakened competition, feeble productivity growth, high inequality, and, not coincidentally, an increasingly degraded democracy. Fixing this is a challenge for us all, but especially for those who run the world’s most important businesses. The way our economic and political systems work must change, or they will perish”.

I strongly recommend his text:

In the section "reflections" I included a chapter about the birthplace of neo-liberalism, the USA. It illustrates some major results of this ideology.

In the section "reflections", chapter "economic paradigms", I already refered to this cristal clear critique of neo-liberalism.

Martin Wolf of the Financial Times states bluntly: "There Is a Direct Line from Milton Friedman to Donald Trump’s Assault on Democracy"

He is regarded as “staggeringly well connected” within financial circles. He is trusted for his independence, and is widely respected as one of the most influential economics journalists in the world. In this article he a.o. states:

“In reality, corporations are powerful entities able to exercise immense influence within society. Since corporations have been told that their only responsibility is to make profits and this has been internalized within their operations, the result is that society, including in particular its notionally democratic politics, is dominated by feral institutions. This is an important reason why the US has ended up with a president who is now running against democracy itself”.

In my view, neo-liberalism still rules strongly in the financial sector – as I have argued in the section “danger & stupidity”, chapter “financial sector systemic risks”:

Chris Watling on March 18, 2021, published his opinion in The Financial Times – “Time for a great reset of the financial system”. Very worthwhile reading:

Apart from the financial sector, is there a new economic paradigm emerging? Is there a new coherent, inspiring narrative available that can be shared?

Is there a network of influential economists and institutions [thinktanks, OECD, World Business Council on Sustainable Development, academic platforms, specialized media, etc.] that enable a new paradigm?

As stated before, each transition features a serious crisis: the prevailing paradigm gets stuck, no longer works and new, successful approaches emerge that better explain reality.

And also the complexity of the international economic reality, the deep global interconnectedness, helps the vested interests to frustrate a paradigm shift.

Major think tanks, like the New Economics Foundation, are calling for fundamental reform of economic policy. An international student movement, Rethinking Economics campaigns for an alternative economics curriculum, CORE.

Already in June 2016 the IMF showed a remarkable change of heart concerning neoliberalism. See the link below to the publication "Neoliberalism: Oversold?". A crystal clear call for a nuanced, but necessary reconsideration.

More and more international business executives are calling for a fundamental "reset" of capitalism; this is a link to a must-read report from the world´s most influential business platform.

It has been particularly interesting to note that a renowned journal such as The Economist - a strong advocate of economic liberalism since its foundation in 1843 - has since 2008 made a critical and nuanced commentary on neo-liberal capitalism. More recently, other renowned publications followed its example.

For far too long, Europe has been bewitched by America. Fortunately, this seems to have changed somewhat recently. Hopefully, Europe will increasingly rely on its own visions of economics and society. And hopefully, will she rely more on her own strengths.

Several economists are leading the pack within the academic profession. And their research and ideas are heard by ever more politicians, business executives, think tanks, and journalists. Their influence is growing rapidly.

Because their research is astute, their ideas are refreshing and appealing. They are completely averse to the established order and go their separate ways. Among them are a few familiar faces [Stiglitz, Sen], whose views have been known for much longer. But a striking number of newer, female economists have entered the international stage during the last five years.

Ha-Joon Chang

Mariana Mazzucato

These academic innovators belong to my favorites. There are many more of course, such as Ann Pettifor, Thomas Piketty, Martine Durand, Dani Rodrik, Steve Keen. And their numbers are growing, just as their influence.

Kate Raworth

Rebecca Henderson

Carlota Perez

Joseph Stiglitz

Stephanie Kelton

Amartya Sen

Esther Duflo

Ha-Joon Chang, about his popular book “23 Things they don´t tell you about capitalism” [32 min.]. He says very considerate things about neo-liberal capitalism. You won’t regret the half hour of your time investment.

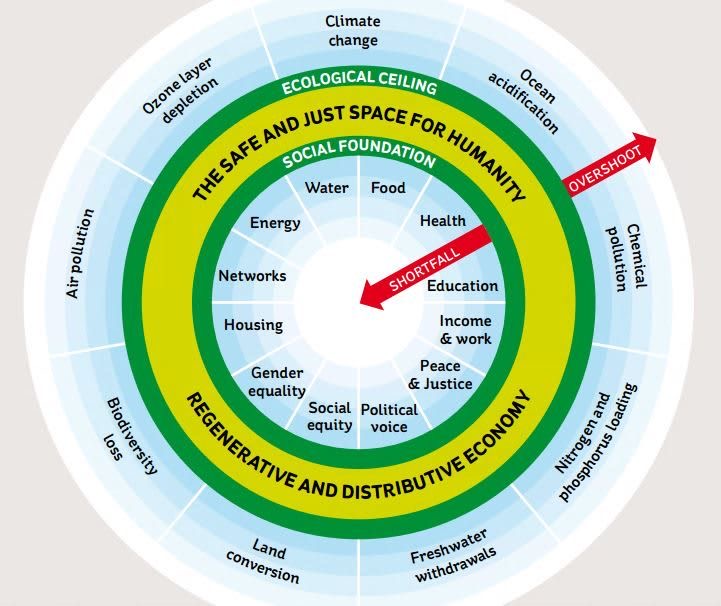

Kate Raworth sharing her vision [15 min.]

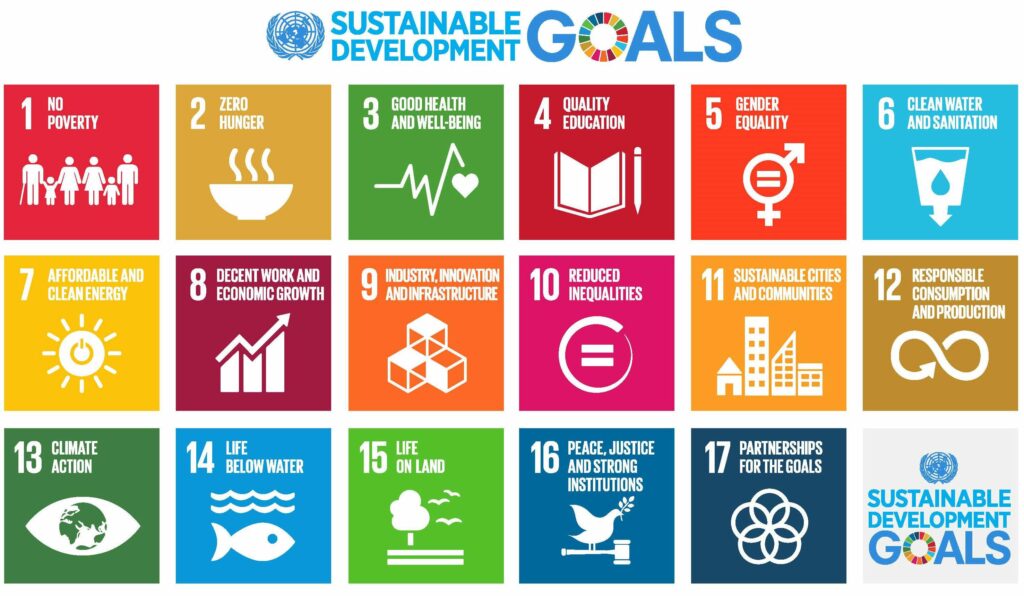

“The 2030 Agenda for Sustainable Development”, adopted by all United Nations Member States in 2015, provides a shared blueprint for peace and prosperity for people and the planet, now and into the future. At its heart are the 17 Sustainable Development Goals (SDGs), which are an urgent call for action by all countries – developed and developing – in a global partnership. They recognize that ending poverty and other deprivations must go hand-in-hand with strategies that improve health and education, reduce inequality, and spur economic growth – all while tackling climate change and working to preserve our oceans and forests”.

[text UN website – see link below]

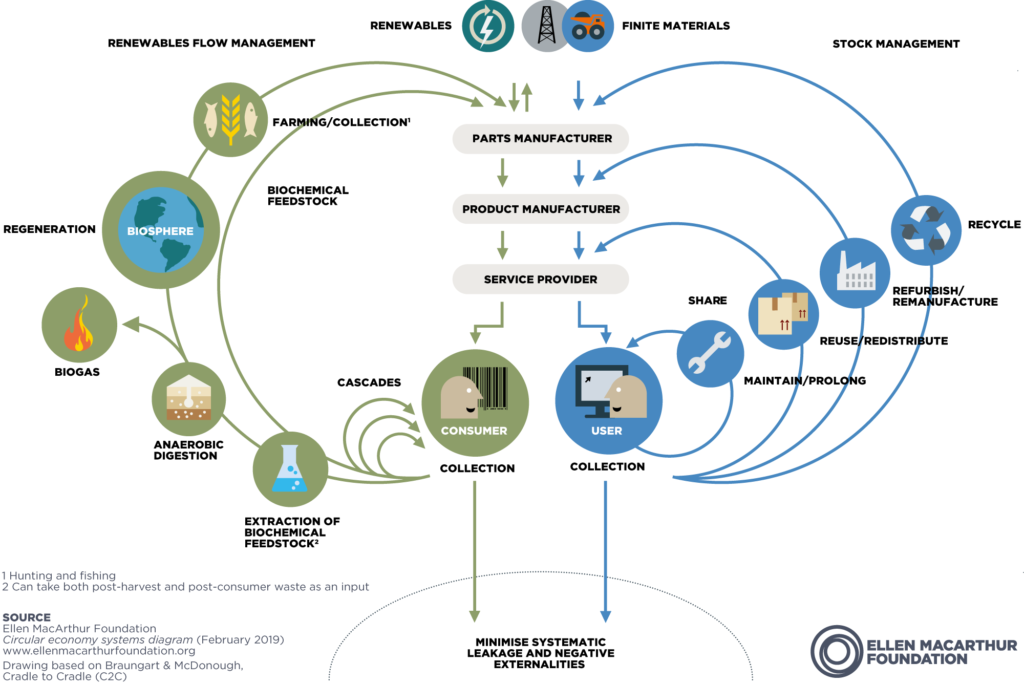

A circular economy mimics nature by creating a closed-loop system, instead of the linear one now [mine, manufacture, use, dump]. It aims at eliminating waste [including carbon emissions] and the continual use of resources. It employs reuse, sharing, repair, refurbishment, remanufacturing, and recycling. The loop can concern technical or organic material – or both. It requires new conceptual thinking in product and process design.

Illustration: Ellen MacArthur Foundation – drawing based on Braungart & McDonough Cradle to Cradle

I can’t think of a better way to close this chapter than by recommending Kate Raworth’s book “Doughnut Economics.” The title sounds a bit simplistic, the content is excellent.

This website is a personal narrative, based on 50 years experience in international business, non governmental organisations and consulting practise. My guest lectures at the Institute of Environmental Sciences [Leiden University, The Netherlands] are derived from it.

Ludo van Oyen – Brussels, 2021

Some photos are taken from the web. If you think your photo is used and you disagree, please send me an e-mail and I will remove it from this site.